Which of the Following Describes the Word Capital Budgeting

Capital budgeting is a method of analyzing and comparing substantial future investments and expenditures to determine which ones are most worthwhile. Number your responses 14.

Chapter 17 Capital Budgeting Analysis Multiple Choice 1 Which Of

Key Takeaways Capital budgeting is used by companies to evaluate major projects and investments such as new plants or.

. Which of the following describes the time value of money. The capital budgeting process is also known as investment appraisal. Questions In a Word document respond to the following.

C an analysis of an investments cash flows prior to committing to the initial investment. Which of the following describes the annual returns that are discounted in determining the NPV of an investment. Its annual cash flows would be 40000 while its annual income flows would be 30000.

In other words its a process that company management uses to identify what capital projects will create the biggest return compared with the funds invested in the project. INTRODUCTION Capital budgeting is the pr ocess that companies use for decision making on capital projects. It involves budgeting for yearly operational expenses.

The cutoff rate of return exceeds cost of capital. B an audit performed only at the end of the projects life span. Capital Budget A budget or plan of proposed acquisitions and replace-ments of long-term assets and their financing.

See also Capital Budgeting. It involves preparing the sales budget for the coming year. It involves analyzing various alternatives of financing available to a company.

Capital budgeting correlates the planning of available financial resources and their long-term investment with a view to maximize the profitability of the firm. The payback period would be ____ years. Assessment Instructions Respond to the questions and complete the problems.

It involves preparing the sales budget for the coming year C. A businesss capital budget is its strategy for generating the projects and ideas that fund the company. Follow up on all capital budgeting decisions compare actual results to expected results because capital budgeting process is only as good as the estimates of the inputs into the model used to forecast cash flows.

Companies often use net present value as a capital budgeting method because its perhaps the most insightful and useful method to evaluate whether to invest in a new capital project. It is more refined from both a mathematical and time-value-of-money point of view than either the payback period or discounted payback period methods. Capital budgeting or capital expenditure budget is a process of making decision regarding investments in fixed assets which are not meant for sale such as land building machinery or furniture.

Difficulties faced in capital budgeting - Uncertainty of variables eg annual cash flows discounting rates changes in technology inflation rate changes in tax rates etc. Cost of capital exceeds the cutoff rate of return. Which of the following best describes a capital budgeting post-audit.

Calculate and interpret accounting income and economic income in the context of capital budgeting. Any cash flow that can be classified as macro-incremental to a particular project is irrelevant in a capital budgeting analysis. All firm cash flows project are relevant in a capital budgeting analysis.

Its IRR is less than the companys cutoff rate of return. Asked Sep 24 2015 in Business by Bobby. Economic profi t EP residual income and claims valuation.

Explain the net present value NPV method for. A post-audit in capital budgeting is a comparison of the actual results of capital investments with the projected results True Capital rationing is a process adopted when a company has limited resources and it must find ways to reduce operating expenses in all of its divisions and units. Question 28 of 40 25 Points Which of the following describes the word capital budgeting.

It is also more insightful in. Net incomes expected to be earned by the project. The time value of money a project with a projected 6-year life would cost 100000.

Describe the create the firm-wide capital budget step of the capital budgeting process. It involves deciding among various long-term investment decisions. Which of the following describes the word capital budgeting.

It involves budgeting for yearly operational expenses B. The purposes of capital budgets are to allocate funds control risks in decision-making and set priorities. A businesss capital budget is its strategy for generating the projects and ideas that fund the company.

Describe the internal rate of return IRR as a method for deciding the desirability of a capital budgeting project. A dollar received today is worth more than a dollar to be received in the future. It involves deciding among various long-term investment decisions D.

Capital budgets are typically requests for purchases of large assets such as property equipment or IT systems that create major demands on an organizations cash flow. A an audit of an operating unit of a company. Which of the following is a capital budgeting method that ignores the time value of money.

The meaning of risk is different depending on the context even when discussing risk in conjunction with capital budgeting. Which of the following best describes the treatment of an incremental cash flow in capital budgeting analysis. Required rate of return or the hurdle rate.

Which of the following factors is not considered by the payback model of capital budgeting. - Lack of adequate capital to undertake all viable profits capital rationing - Lack of adequate information on the available investment opportunities eg in. A capital budget is devel-oped by using a variety of capital budgeting techniques such as the payback method the net present value NPV method or the internal rate of return IRR method.

The following information. Describe and contrast the following valuation models of a capital project.

Capital Budgeting Adalah Pengertian Manfaat Metode Dan Prinsip Dasar Accurate Online

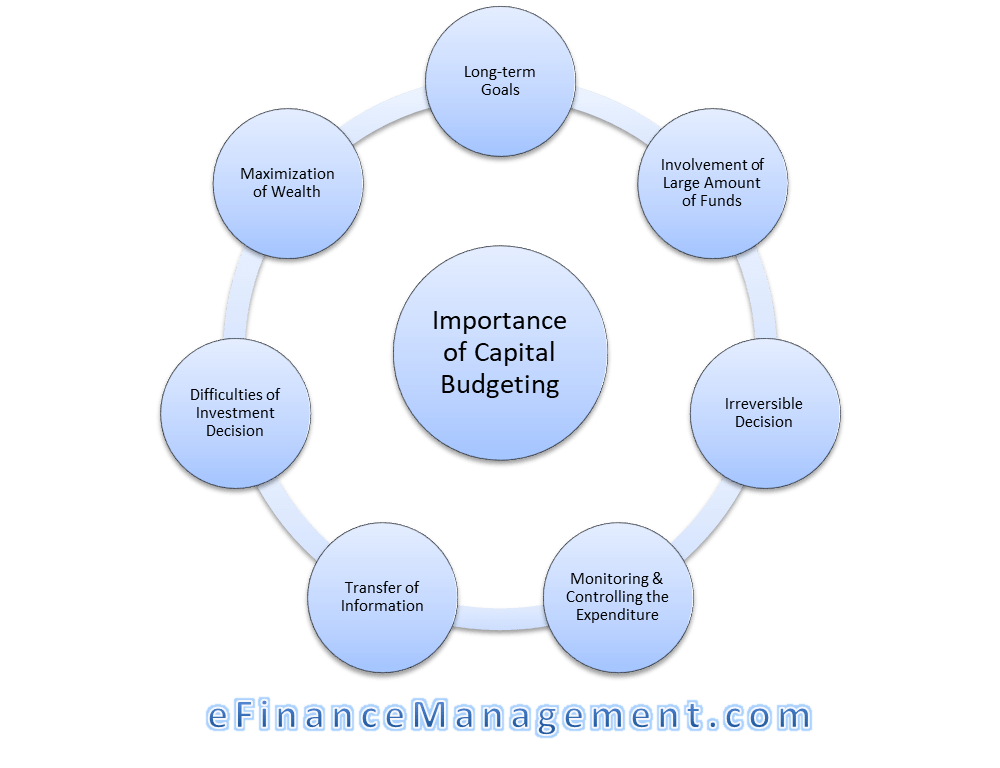

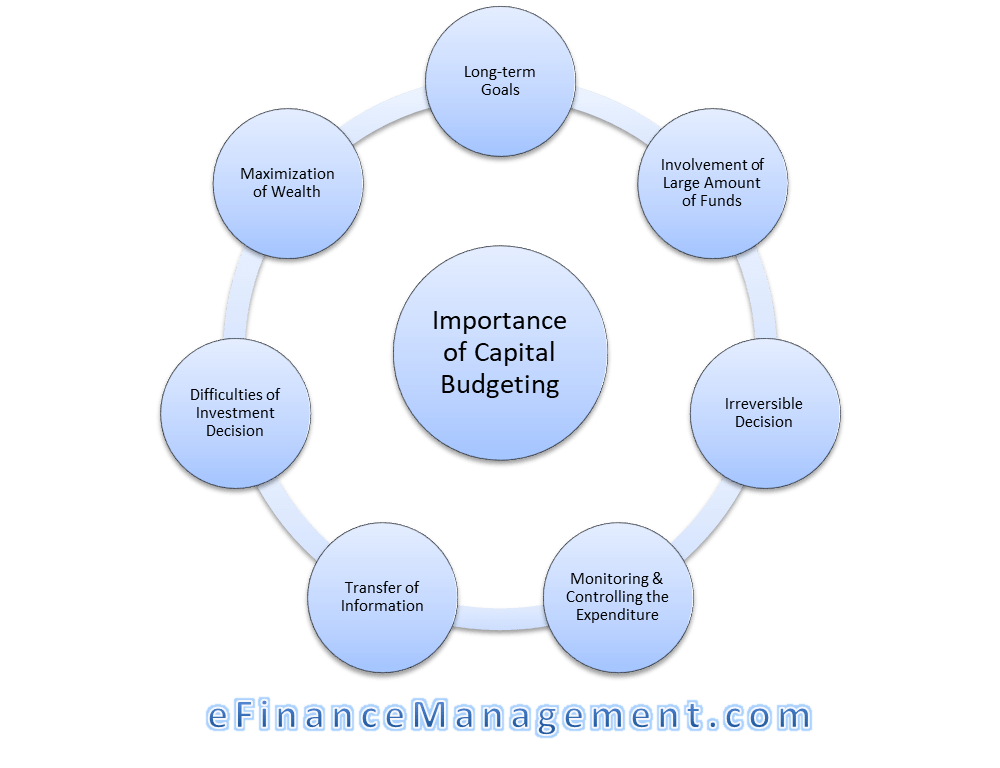

Importance Of Capital Budgeting Meaning Importance

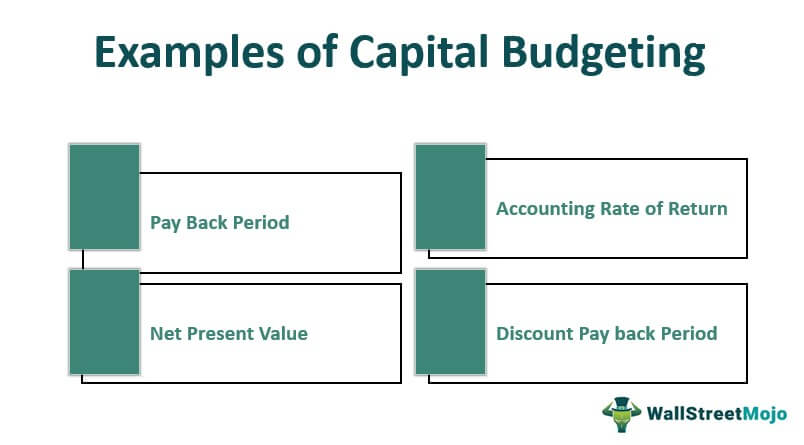

Capital Budgeting Examples Top 5 Capital Budgeting Technique Example

Comments

Post a Comment